Is ecommerce growing? Absolutely. And 2025 marks a turning point. What was once occasional has become routine, and what used to feel like “the future” — AI shopping assistants, instant delivery, personalized recommendations — is quickly becoming the expectation.

To cut through the noise, Alokai conducted an independent survey of 2,500 respondents to gather the most important ecommerce statistics and give some context to the increase in online sales.

Unlike many industry roundups, this study:

- Explores ecommerce personalization trends

- Provides a detailed ecommerce pain-points assessment

- Dives into the most promising ecommerce demographics

- And discusses the role of AI in retail trends.

So it's not just statistics about ecommerce or a forecast towards inevitable ecommerce sales increase. It's comprehensive market analysis with actionable tips and insights straight from the experts.

Let's get started!

1. Shopping frequency: Ecommerce growth promises to become a daily habit

The idea that people “occasionally” shop online is outdated. Perhaps the most important of all the latest ecommerce trends is the fact that shopping is now part of daily routines:

- 53% of shoppers buy online several times a week or more

- Nearly three-quarters (73%) shop at least once per week.

Think about what that looks like in practice. A parent places a quick grocery order for midweek essentials. A young professional buys replacement headphones during a lunch break. Someone else restocks skincare products late at night after scrolling social media. These aren’t “shopping sprees”, they’re woven into ordinary routines.

For retailers, the implication is profound. If ecommerce is constant, expectations are constant. Shoppers are comparing every checkout, every delivery, and every return policy not just against your competitors, but against the best digital experience they’ve had this week.

What this means for you: Build for speed and convenience. Fast checkout, one-click payments, and options like subscriptions or automatic replenishment help frequent buyers stick with you.

2. Top ecommerce industry stats: Which product categories take the lead

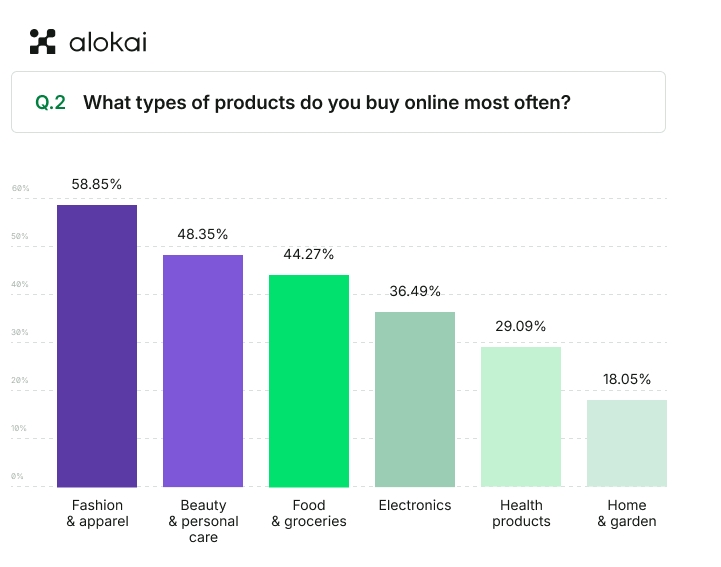

Not all categories benefit equally from ecommerce sales growth. Some remain impulse-driven, while others are solidifying as staples. The clear leader, however, is indisputable: fashion.

58.9% of respondents say they buy fashion and apparel most often online, putting it far ahead of other categories. At first glance, this seems predictable; fashion has long been leading in ecommerce industry statistics. But there’s a deeper story.

Groceries, once thought to be resistant to digital adoption, now rank among the top categories. The pandemic gave this sector a push, and the habit has stuck. Families with multiple children and lower-income households in particular show stronger preference for buying groceries online, proving that ecommerce is no longer just about indulgence; it’s about convenience and necessity.

Keep that in mind next time you research ecommerce sales by product category.

Category splits by demographic:

- Women dominate fashion and beauty spending, while men lean toward electronics.

- Lower-income households and families with multiple children show a stronger preference for groceries.

What this means for you: Fashion and beauty sellers should invest in brand experience and discovery features, while grocery retailers win by optimizing for speed, transparency, and convenience.

3. Marketplaces vs brand sites vs social commerce

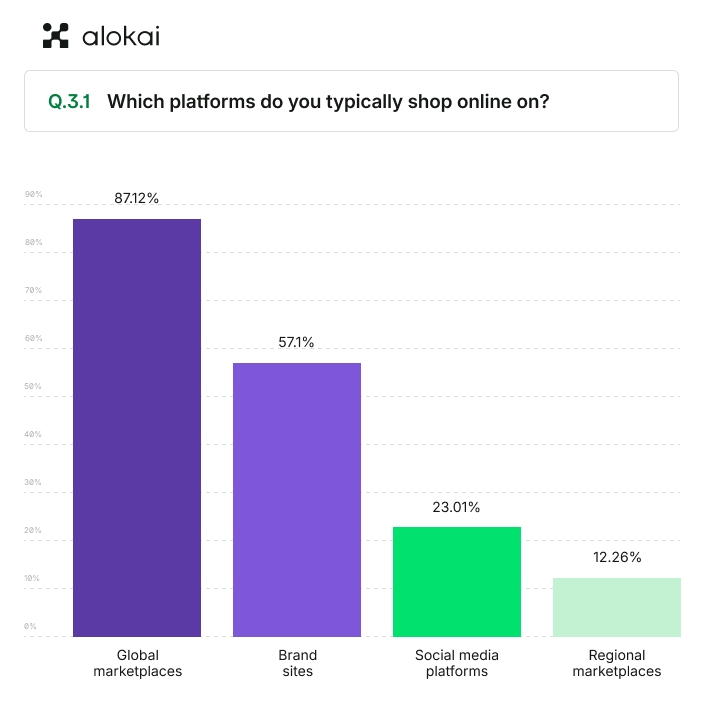

It's no longer ecommerce vs marketplace. Today, if ecommerce is where people shop, marketplaces are how. The scale is staggering: our ecommerce statistics suggest that 87% of respondents say global marketplaces are among their top shopping destinations. Amazon, AliExpress, and Temu have become the default entry points for millions of consumers. But that’s not all:

- 57% also shop directly from brand websites.

- Nearly half use both, treating marketplaces as discovery engines and brand sites as loyalty hubs.

- Social commerce is booming among younger cohorts

It's less about marketplace vs ecommerce, and more about how this multi-channel reality matters for strategy. Ecommerce statistics show clearly that shoppers don’t see channels as competing silos; rather, they move fluidly between them. They might discover a product on TikTok, price-compare it on Amazon, and finally buy it from the brand’s own site.

What this means for you: Treat marketplaces and brand sites as complementary, not competitive. Marketplaces extend reach, but your owned store is where you can create differentiation, loyalty, and higher customer lifetime value. Social commerce, meanwhile, is a discovery-first channel that’s essential if your audience skews young.

4. What drives ecommerce sales – and what stops them

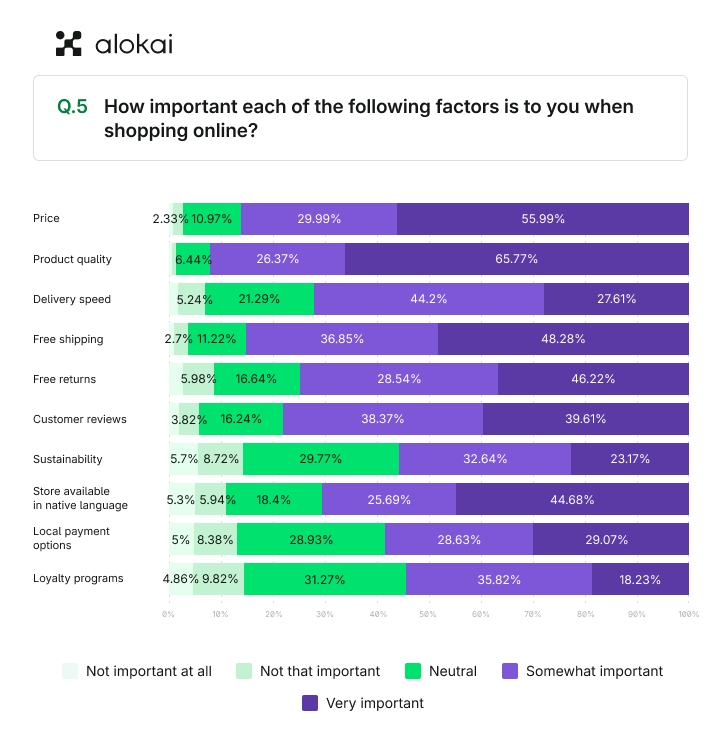

Marketers often assume price is the ultimate motivator, but our ecommerce statistics bring a surprising discovery. When asked what drives purchase decisions:

- 65% say product quality

- 56% prioritize price.

- 48% value free shipping

This doesn’t diminish the role of pricing. Cost still matters deeply, but the highlight is something more fundamental: shoppers want to trust what they’re buying. In an era when fast fashion and low-cost imports flood marketplaces, assurance of quality becomes the deciding factor.

That assurance doesn’t just come from the product itself, but in how you present it: detailed product descriptions, authentic reviews, clear sizing charts, and guarantees of durability. Quality is as much about perception as it is about reality, and an ecommerce storefront must communicate that confidence clearly.

What this means for you: Conversion is won (or lost) on fundamentals. Be transparent about costs, invest in frontend performance, and make returns easy. Flashy campaigns can’t compensate for broken basics.

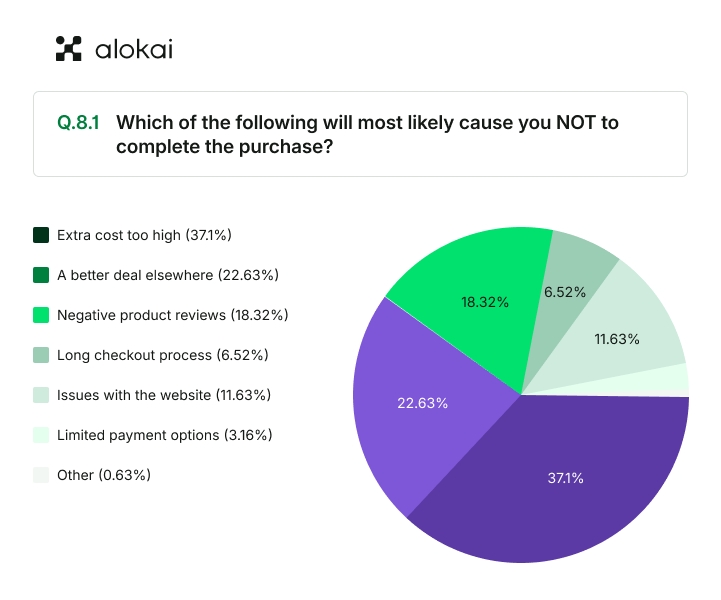

Ecommerce pain points: The checkout “gotcha”

Nothing undoes trust faster than surprise costs. More than a third of shoppers (37.1%) abandon their cart because of extra charges like taxes or shipping. In fact, hidden fees were cited as the single most frustrating part of ecommerce, ranking even above slow websites and poor customer service.

More than about the money itself, this is about the feeling of being misled. A shopper who thought they were paying $50 but sees $62 at checkout feels cheated, even if the difference is explainable.

The lesson is straightforward but often ignored: show total cost early, and experiment with pricing structures that simplify decisions. Free shipping thresholds, flat-rate delivery, or membership models that remove per-order fees all help reduce the “gotcha” effect.

5. Ecommerce payments trends: Familiar beats flashy

Payments have been one of the most hyped frontiers of ecommerce industry growth, with digital wallets, cryptocurrencies, and Buy Now, Pay Later repeatedly referred to as the latest trends in payments industry. However, ecommerce statistics show that familiarity still rules: two-thirds of respondents (67.6%) prefer to pay with credit or debit cards.

PayPal sits comfortably in second place, while wallets and BNPL options remain niche. Younger shoppers are more willing to experiment, but for most consumers, cards remain the trusted standard.

This doesn’t mean that digital payments trends are irrelevant. Wallets and BNPL can make a difference in competitive segments, especially with younger cohorts or in regions where they’re more established. But no retailer can afford to skip the basics. If checkout doesn’t support cards and PayPal flawlessly, everything else is irrelevant.

What this means for you: Cards and PayPal should be your non-negotiables. Wallets and BNPL can boost conversion, but only if they align with your audience. For global brands, tailoring payment options by market is critical.

6. AI in ecommerce: Demand vs trust

AI dominates conversations in every industry, but what do shoppers actually want it to do? The answer is refreshingly grounded.

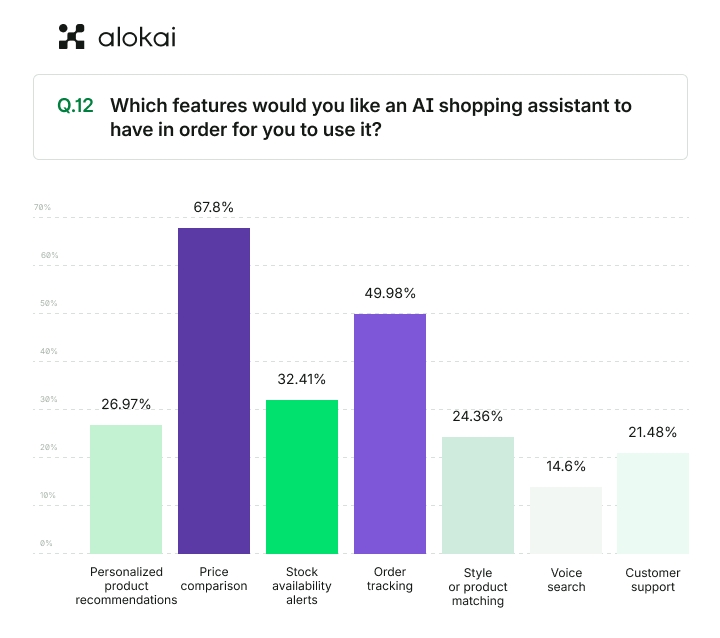

67.8% say they’d like AI to compare prices, while half want it to help with order tracking and a third would use it for stock availability alerts.

Additionally:

- 50% want help with order tracking.

- Only 14% fully trust AI product recommendations.

Notice what’s missing: people aren’t asking for AI to predict their taste in fashion or write their shopping lists. They want it to solve everyday frustrations. That’s an important reality check for retailers tempted to launch flashy features that don’t map to real needs.

This hesitation isn’t surprising. Money is personal, and trust is fragile. Shoppers may welcome AI that helps them save time or spot a deal, but giving it control of their wallet is another matter entirely. Over time, as shoppers experience reliable AI tools, their trust may grow. But pushing too aggressively could backfire.

What this means for you: Start small with AI trends in retail: use AI for practical conveniences like smarter search, tracking, and price alerts. Avoid pushing AI too far into money management or core decision-making until trust builds.

7. Ecommerce users’ demographics: who shops, and how

Our ecommerce statistics show important nuances in how different groups shop and what frustrates them most:

- Younger shoppers (18–34)

- Women report higher frustration levels

- Older shoppers (45–64)

An important note here is that women drive a disproportionate share of spending in key categories like fashion, beauty, and household goods. If these pain points aren’t addressed, brands risk alienating their most valuable customers.

The good news? Many of these frustrations are fixable. Clearer product descriptions, faster sites, and streamlined return flows don’t improve the experience for everyone; but recognizing where the customer pain points in ecommerce hit hardest helps prioritize what to fix first.

What this means for you: Don’t build a one-size-fits-all ecommerce experience. Tailor UX and messaging to different cohorts. For younger buyers, emphasize speed, variety, and alternative payments. For older ones, focus on clarity, trust, and reliability.

Summary: where to focus in 2025

- Fee transparency is non-negotiable.

- Frontend performance equals revenue.

- Offer the right payment mix.

- Use AI conservatively.

- Play the channel mix smartly.

Meeting those expectations isn’t about one-off fixes — it’s about building an ecommerce foundation that can adapt quickly. Alokai’s composable technology makes this possible.

With multistore capabilities you can localize experiences across regions and languages without creating complexity. And with a composable storefront, you can guarantee the performance and flexibility shoppers demand while testing new ideas faster.

Why these ecommerce statistics matter

Ecommerce in 2025 is shaped by habits. Shoppers buy online multiple times a week, expect transparency around costs, and move seamlessly between marketplaces, brand sites, and social platforms. They’re curious about AI, but only when it solves practical problems, and they still lean on familiar payment methods like cards and PayPal.

What ties all of this together is trust. Whether it’s trusting that shipping won’t double the price at checkout, that a site will load quickly, or that a return will be handled smoothly, customers reward brands that deliver reliability at every step.

This article highlighted ten of the most telling statistics, but the full study goes deeper — with detailed demographic splits, category-level insights, and frustration patterns you can act on.